Ours is a community full of generosity. Taking advantage of the charitable tax deduction is just one way to enhance your own year-end giving.

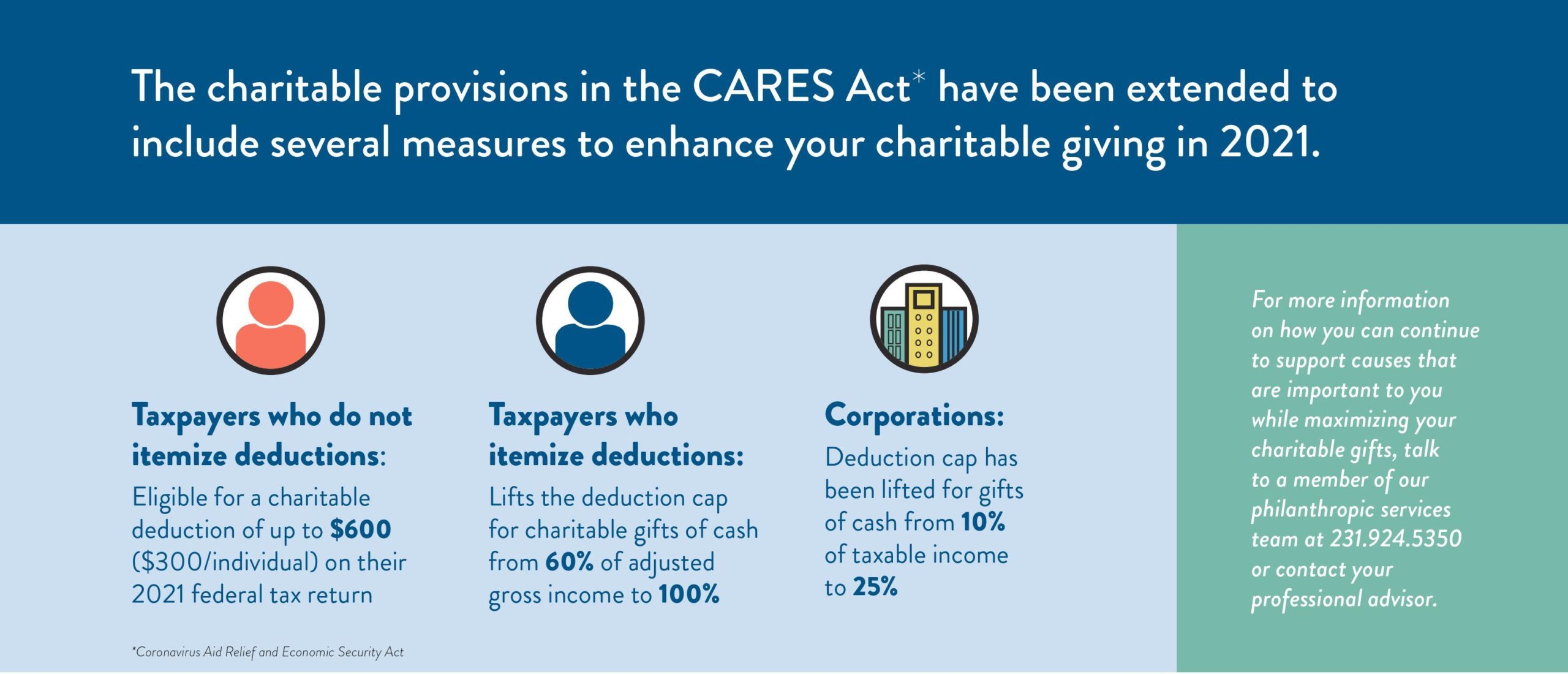

The charitable provisions in the CARES Act (Coronavirus Aid Relief and Economic Security Act) have been extended to include several measures to enhance your charitable giving in 2021.

- Taxpayers who do not itemize deductions:

Eligible for a charitable deduction of up to $600 ($300/individual) on their 2021 federal tax return - Taxpayers who itemize deductions:

Lifts the deduction cap for charitable gifts of cash from 60% of adjusted gross income to 100% - Corporations:

Deduction cap has been lifted for gifts of cash from 10% of taxable income to 25%

These measures do not apply to gifts to donor advised funds.

For more information on how you can continue to support causes that are important to you while maximizing your charitable gifts, talk to a member of our philanthropic services team at 231.924.5350 or contact your professional advisor.